In the fast-paced world of crypto trading, having the right tools to execute trades efficiently can make all the difference. With the rise of Solana-based assets and the growing demand for automated trading, two bots have gained significant attention: BONKbot and Trojan. Both bots serve the Solana ecosystem, but which one is best for you? This article will dive into a head-to-head comparison of BONKbot and Trojan, focusing on their features, benefits, and potential drawbacks. Let’s explore which of these Solana trading bots can elevate your trading game.

What is BONKbot?

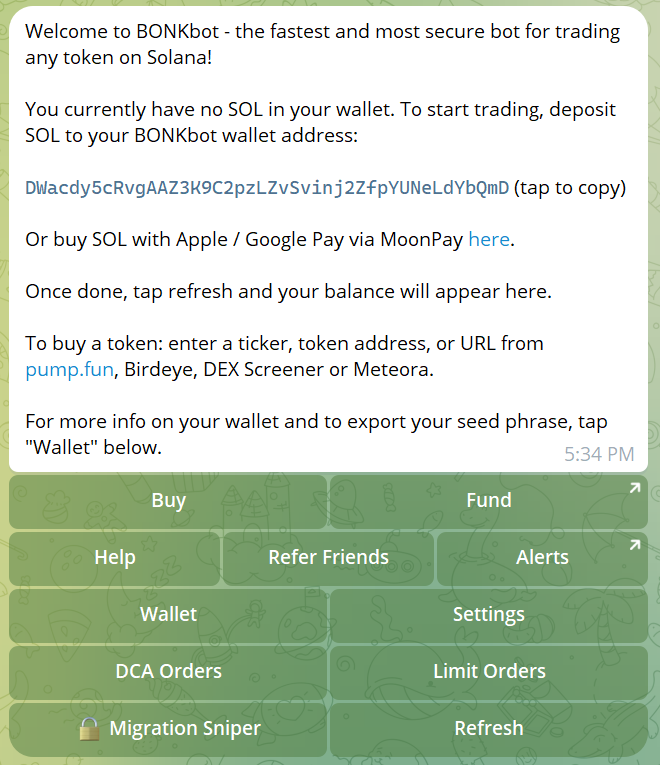

BONKbot is an automated trading bot designed for the Solana blockchain, making it ideal for those who want to trade SPL tokens with speed and efficiency. With its integration into Telegram, the bot provides users with a simple, user-friendly interface to manage their portfolio and execute trades directly from their mobile devices or desktop.

Key features of BONKbot include:

- Fast Execution on Solana’s Blockchain: Leverages Solana’s high-speed and low-fee environment to ensure fast and efficient trade execution.

- MEV Protection: Provides protection against Maximal Extractable Value (MEV) bots, ensuring that your trades are not unfairly manipulated.

- Customizable Slippage Settings: Users can adjust slippage settings for more flexibility in trades.

- Security Features: The bot uses two-factor authentication (2FA) for added security and operates on a non-custodial model, meaning that users retain control over their funds.

- 24/7 Automated Trading: BONKbot runs around the clock, enabling users to trade at any time without having to monitor the markets manually.

BONKbot is particularly popular within the $BONK community but supports a wide range of other Solana-based tokens. It’s a great option for both beginners and experienced traders, thanks to its simple interface and customizable settings.

What is Trojan?

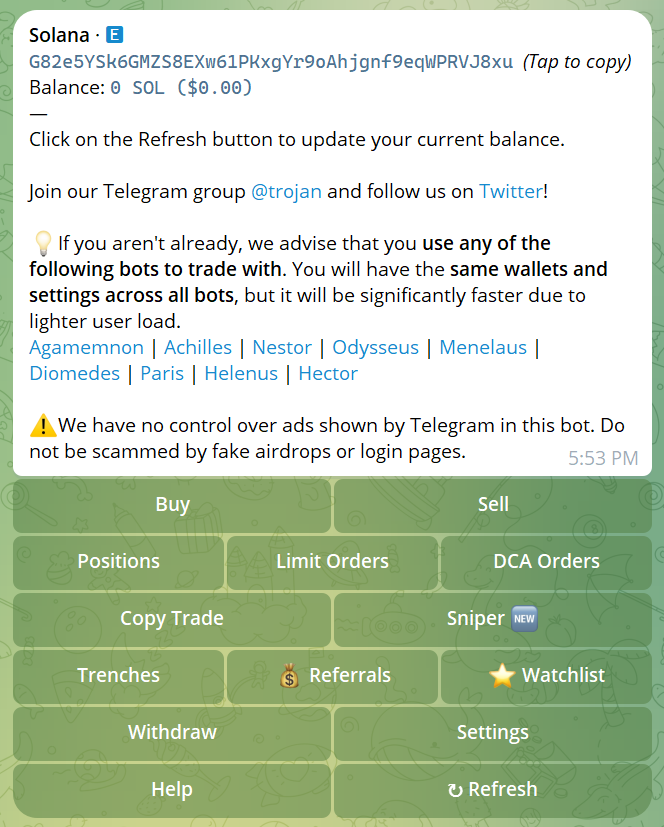

Trojan is another Solana-based trading bot, designed to offer users a sophisticated and feature-packed way to automate their trading strategies. Trojan aims to combine the power of DeFi with ease of use, making it accessible for traders at all levels. With an emphasis on advanced trading logic and customizable options, Trojan seeks to give users more control over their trading decisions.

Some standout features of Trojan include:

- Advanced Trading Logic: Trojan supports various strategies, such as limit orders, stop-loss, and take-profit orders, which allow users to execute more nuanced trading strategies.

- Cross-Platform Integration: While Trojan is based on Solana, it’s compatible with other ecosystems like Ethereum and BNB Chain, offering a broader scope for multi-chain traders.

- Highly Customizable: Trojan’s interface allows users to tailor their trading experience by setting specific parameters such as trade amounts, execution speeds, and slippage tolerance.

- Real-Time Analytics and Insights: Trojan offers real-time analytics that can help traders optimize their strategies based on current market conditions.

- Community Features: Similar to BONKbot, Trojan has a strong community focus, providing users with educational content and social trading features.

While Trojan offers more advanced features and supports multiple blockchains, it can be more complex to set up compared to BONKbot, which may intimidate newer traders.

BONKbot vs Trojan: A Comparison

Let’s break down the key differences between these two bots based on the following criteria:

1. Ease of Use

- BONKbot: Designed with simplicity in mind, BONKbot is ideal for beginners. Its integration with Telegram means users can easily access the bot from their phone or computer without a steep learning curve. BONKbot is great for users who want to start trading without too many complex configurations.

- Trojan: Trojan offers a highly customizable interface, which can be appealing to advanced users. However, this comes at the cost of a steeper learning curve. Setting up specific trading strategies may require more time and technical know-how, which could be a barrier for those new to crypto trading.

2. Trading Strategies

- BONKbot: BONKbot focuses on basic automation with customizable slippage settings, MEV protection, and fast trade execution. Its simplicity may be limiting for those who wish to implement more advanced trading strategies, such as stop-losses or limit orders.

- Trojan: Trojan shines in the advanced strategies department. Users can implement a variety of trading tactics, including limit orders, stop-loss, and take-profit functionality. This makes Trojan a better choice for traders who want more control over their trades and want to execute more sophisticated strategies.

3. Security Features

- BONKbot: BONKbot emphasizes security with its two-factor authentication (2FA) and non-custodial model, meaning your funds remain in your personal wallet and are never under the bot’s control. This is a significant advantage in terms of security and gives users full control over their assets.

- Trojan: Trojan also takes security seriously but doesn’t highlight 2FA in the same way as BONKbot. It’s still secure but may not have the same level of emphasis on individual user security features like BONKbot.

4. Speed and Efficiency

- BONKbot: Leveraging the Solana blockchain, BONKbot offers lightning-fast transaction speeds with low fees, ensuring that trades are executed quickly, even during periods of high volatility.

- Trojan: Trojan also benefits from Solana’s speed but can be slightly more complex in terms of how trades are executed due to its advanced strategy capabilities. For users focusing purely on speed, BONKbot is likely the more straightforward choice.

5. Multi-Chain Support

- BONKbot: BONKbot is Solana-exclusive, meaning it only supports SPL tokens. While it’s excellent for the Solana ecosystem, it lacks the flexibility of supporting other blockchain networks.

- Trojan: Trojan has an edge when it comes to multi-chain support, as it operates not just on Solana but also on networks like Ethereum and BNB Chain. This makes it the go-to choice for traders looking to diversify across multiple ecosystems.

Conclusion: Which is Right for You?

The decision between BONKbot and Trojan ultimately comes down to your trading preferences and experience level:

- BONKbot is a great choice for beginners or those who prefer a simple, fast, and secure solution for Solana-based trading. It’s easy to use and offers essential features like MEV protection and customizable slippage settings, making it a solid option for casual traders who don’t need complex features.

- Trojan, on the other hand, is better suited for experienced traders or those looking for more advanced functionality. If you want to implement specific strategies like stop-losses, limit orders, and other complex trade management tools, Trojan gives you the control and flexibility needed. Plus, its multi-chain support opens up opportunities for traders working across different blockchains.

Both bots are solid options, but choosing the right one depends on your level of experience, trading goals, and the specific features you value most.